Mention the Different Budgeting Periods and Explain Each

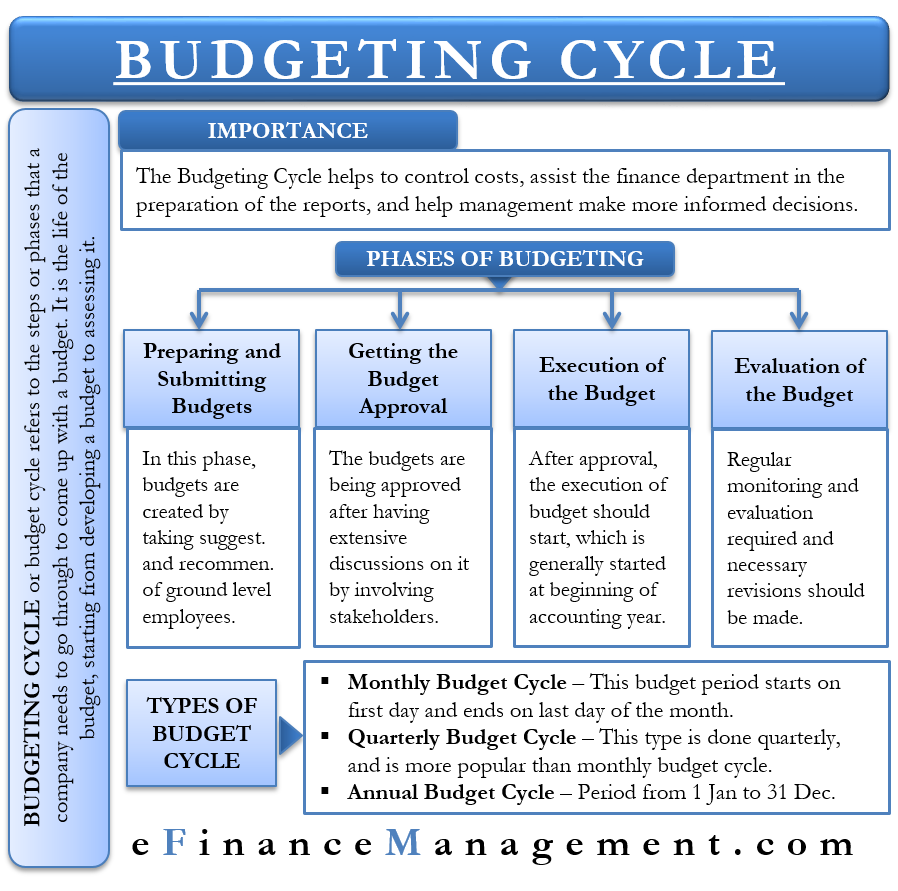

The contingency budget can be used flexibly across any of the budget headings. A budget cycle includes the time for planning preparing approving executing and evaluating the budget.

Diagram Of The Budgeting Process Budgeting Budget Planning Financial Strategies

Capital budgeting for a small scale expansion involves three steps.

. Sales budget production budget cash budget are all prepared for a financial period of one year. For example if a company prepares the budget quarterly then the budget period will be three months. Although the terms used to identify the four phases within the.

The budget period is the period of time during which you are authorized to spend the funds awarded and must meet the matching or cost-sharing. You can learn more about accounting from the following articles Capital Budgeting Methods. What is zero based budgeting.

Budget is prepared for a specified period of time usually for a year. I Sales Budget ii Production budget iii Financial budget iv Overheads budget v Personnel budget and vi Master budget. 3 program and planning program budgeting.

1111 Different decisions are made by different people at each step of the budget process. It is a traditional method. A budget is essential for any organization.

Some companies are preparing a budget for more than one year and some companies limit the period to one year. The contingency budgeting technique uses a broad approach to budgeting. The manager takes the previous periods budget as a benchmark.

But the budget cycle will start before the quarter and end after the quarter. For business of a seasonal nature the budget period should cover at least one entire seasonal cycle. And 6 outcome-focused budgeting.

Adjustments can be made for each budget period so you can adjust the amount each month to increase budgeted totals by a set amount or by percentage. In each case explain your choice. Here we will discuss the Top 5 methods of Capital Budgeting along with formula explanation examples.

The budget period should be long enough to cover complete production of various products. This process involves planning and forecasting implementing monitoring and controlling and finally evaluating the performance of the budget. Budgets are then built around.

4 zero-based budgeting ZBB. This requires that expenditures for any given time period be adjusted according to revenues for the same period. Zero-based budgeting ZBB is a method of budgeting in which all expenses must be justified for each new period.

Its the different phases of budget planning and implementation through different budgeting periods. Capital budgeting projects are accepted or rejected according to different valuation methods used by different businesses. Example of Capital Budgeting.

It is known as a nerve centre or backbone of the enterprise. Various budgeting models continue to be commonly used and fall predominantly into the following categories. Some of types of Budgets are.

Each new level of management has responsibility for reviewing and negotiating any changes in. Regardless of its focus the budget cycle begins with planning and ends with a thorough evaluation. To create a new budget zero-based budgeting ZBB necessitates the justification of all manner of budget expenditures and line items on the balance statement.

Under certain conditions the internal rate of return IRR and payback period PB methods are sometimes used instead of net present value NPV which is the most preferred method. Different methods of preparing financial plans are as follows. A business budget typically progresses in phases that in total produce a complete budget life cycle.

You need to monitor the people and processes that have an impact on the development problem that you want to address and gather evidence. Organizations within the Department of Health and Human Services use a method of funding for discretionary grants that divides an approved project into funding periods called budget periods. This type of budgeting is probably most appropriate for large well-established sports medicine clinics during periods of relative economic certainty.

Cash Budgets A cash budget projects all cash inflows and outflows for the next year. This is a great way to budget for growth. The expense budget indicates all expected expenses of a firm for the coming year while the revenue budget shows all projected revenues for the coming year.

A sales budget is an estimate of expected total sales revenue and selling expenses of the firm. What is a budget period. Generally a budget period depends upon nature and type of business.

The budgeting process is the process of putting a budget in place. There are different techniques to decide the return of investment. This has been a guide to Capital Budgeting Techniques.

Further the anticipated percentage change is either summed up or deducted to formulate the current budget. 1 Incremental Budgeting. The budget period on the other hand is the actual period to which the budget applies.

1 line-item or traditional budgeting. Recording the investments cost projecting the investments cash flows and comparing the projected earnings with inflation rates and the time value of the investment. On this account this approach is implemented irrespective of the previous periods spending as opposed to the above-mentioned traditional method of modifying past actuals.

It helps to keep track of its income and expenditure. Participatory budgeting is a budgeting process that starts with departmental managers and flows through middle management and up to top management. - 2 4-week periods followed by 5 week period each quarter 12 accounting blocks each year Incremental Budgets operating budget based on the previous years.

A parent organization provides an athletic. Up to 256 cash back Zero-based budgeting requires managers to build budgets from the ground up each year. A contingency amount is provided to compensate for poor estimates changes in demand and insufficient resources.

Limited effort is used to establish estimates for each budget heading. The budget period should be long enough to allow for the financing of production well in advance of actual needs. A budget is comprehensive ie all the activities and operations of an organisation are included in the budget.

Budgeting Cycle Meaning Importance Phases And More

Rolling Budget Continuous Budget Approach Advantage Disadvantage

Comments

Post a Comment